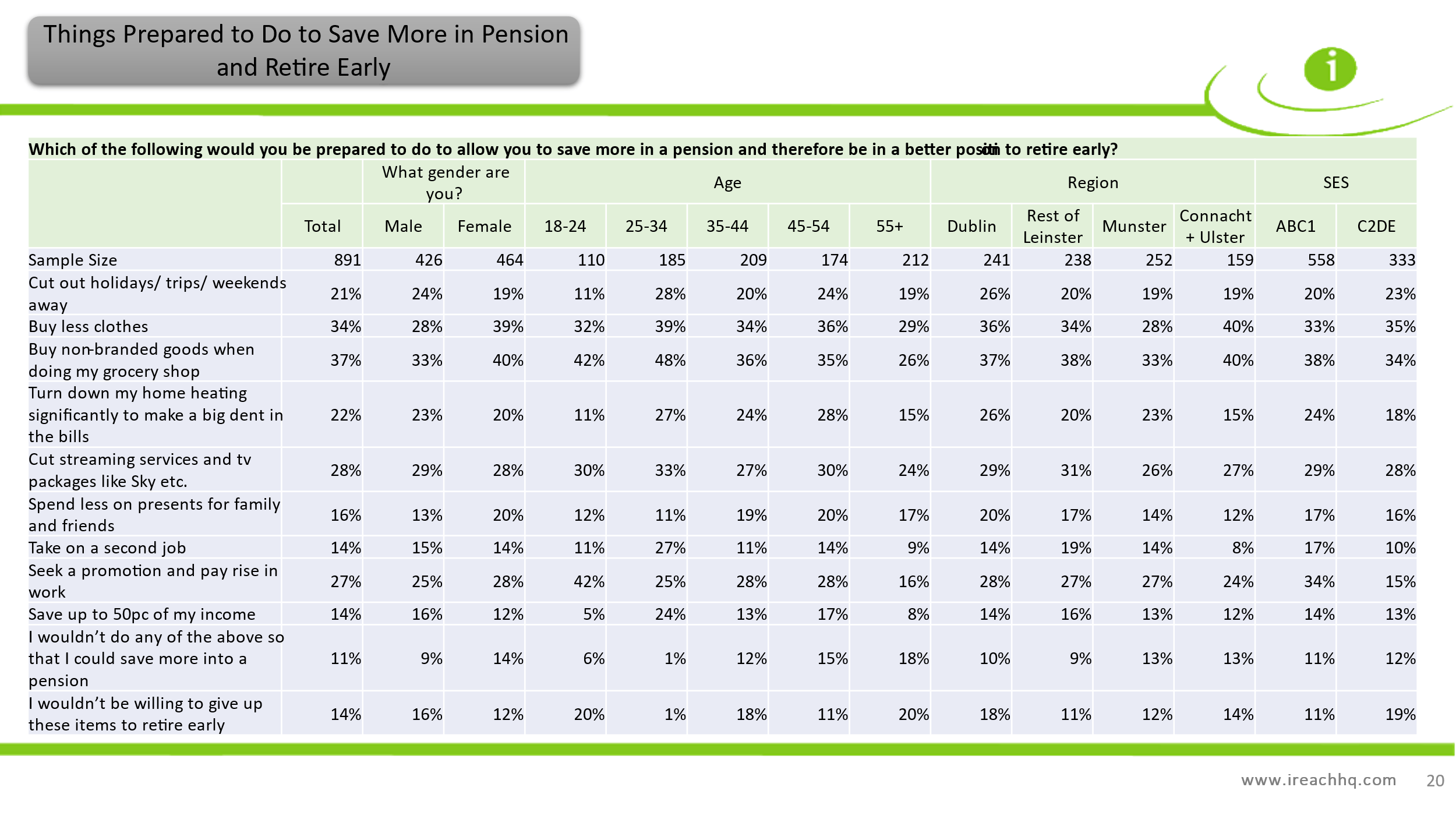

The vast majority of Irish people (79pc) are not prepared to cut back on their annual holidays to allow them the financial capacity to retire early. An even greater number (84pc) would not be happy to spend less on presents for family or friends if doing so could better their chances of giving up the day job before they hit 65.

Furthermore, women in Ireland would be more likely than men to cut back on gifts (20pc versus 13pc), buy less clothes (39pc versus 28pc) and buy non-branded groceries (40pc versus 33pc) in order to better their chances of retiring early whereas men are more likely to cut back on holidays (24pc versus 19pc) and turn down the heating (23pc versus 20pc).

This is according to the results of a new survey of almost 900 Irish adults nationwide, which was commissioned by Gallagher, an Irish insurance broker and financial advisor. The survey examined the sacrifices people would be prepared to make and other steps they would be happy to take to set themselves up to retire early.

The survey revealed that the Top Five steps which people would take to retire early include:

1. Buy non-branded goods during the weekly grocery shop (37pc of those surveyed said they would be prepared to do so)

2. Buy less clothes (34pc)

3. Cut streaming services and tv packages like Sky etc (28pc)

4. Seek a promotion and pay rise in work (27pc)

5. Turn down home heating significantly (22pc)

Commenting on the survey findings, Jonathan Roche-Kelly, Director of Financial Services for Gallagher in Ireland, said:

“The thought of being able to give up your jobs in your 50s or even early 60s might appeal to many people, but to make this a reality in the future, the sacrifices would need to be made now, and understandably, there is only so far people are willing or able to go. Cost-of-living pressures and more pressing financial commitments – such as mortgages, rent and childcare – often mean people aren’t in a position to make the financial sacrifices that might allow them to retire early. While others simply relish the lifestyle they are leading and don’t wish to change it.

It is perhaps unsurprising that few would be prepared to sacrifice travel in order to retire early. The number of Irish people heading abroad for holidays has surged in recent years – the latest figures from the CSO on this show that Irish people took 43pc more holiday trips abroad in the first three months of 2024 when compared to the same months in 2023.

Interestingly, our survey has found that Irish people are more prepared to cut back on more run-of-the-mill items such as clothes, TV subscriptions and branded grocery items – in order to free up more money to save in their pension. Cutting back on these day-to-day items alone is unlikely to generate the savings that would be required in order to retire early, though – much bigger financial sacrifices and lifestyle changes would likely have to be made. This could include cutting overall expenses to the bone – including the much-loved sun holiday – and even embarking on a complete change of career so that more income is earned and, in turn, saved.”

Other headline findings from the Gallagher survey reveal that:

— One in seven (14pc) would be prepared to take on a second job in order to better their chances of retiring early with a similar number (14pc) saying they would be happy to save half their income.

— One in four (25pc) said they wouldn’t be prepared to give up certain items – or take other steps – in order to be able to save more into their pension and retire early.

— Those aged 25-34 are most likely to make some sacrifices in order to retire early, with only 2pc of this age cohort saying they wouldn’t do so. This compared to 30pc of those aged 35-44 and 38pc of those aged over 55.

Mr Roche-Kelly added:

“From the findings, it looks like the older people get, the less likely they are to make cutbacks– but perhaps they simply don’t see any areas in which they can do so.

Interestingly our research found that whether or not someone currently saves into a pension has little bearing on what they would be willing to forgo. It is generally advisable to start saving for retirement as early as possible, as this not only can help you increase your retirement fund but you could also benefit from sizeable tax savings along the way.

The concept of FIRE (Financial Independence Retire Early) has gained momentum in recent years with many people tempted by the notion of retiring early. But in many cases, people simply won’t be in a position to retire early because cost-of-living pressures and other financial commitments mean they simply can’t afford to set aside the necessary savings.

Regardless of what age you plan to retire, you should be very clear about how much money you will need to live comfortably in these later years. Furthermore, it is important to start considering how you can go about putting some money aside to hit that target. Getting the advice of an impartial financial advisor can be invaluable in this regard – an advisor will help ensure your retirement planning is on track and that you take the steps necessary to build up sufficient income for when you retire.”